We all know that saving money is essential – but not everyone knows how to save money effectively. Like most Americans, you probably have a pretty standard budget. The monthly expenses are calculated, and cash is spent on whatever bills need to be paid that month. Many people don’t realize that by not spending the money they have going into their budget, they increase their expenses by hundreds of dollars a month! Here are four simple ways to improve your finances this month to cut back on unnecessary costs.

Define Your Needs

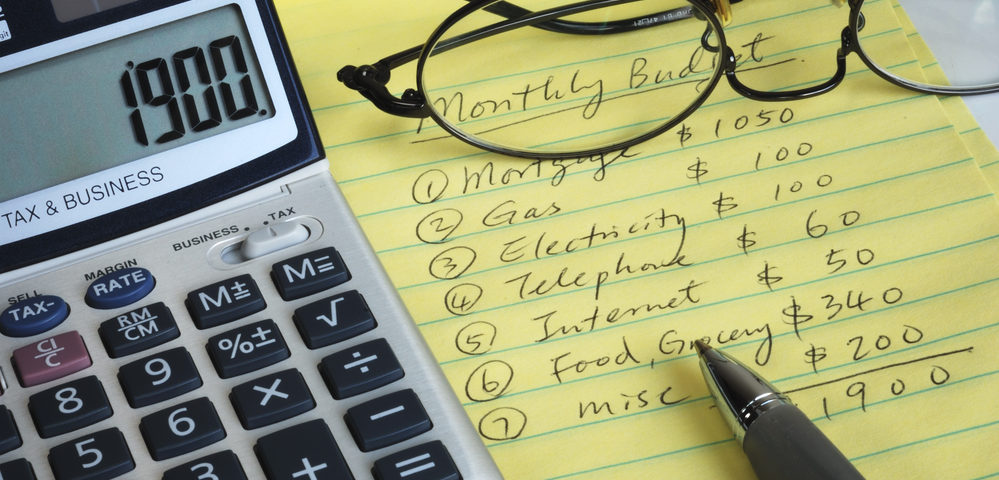

When it comes to saving money, there are a few things that you need to keep in mind. First, your monthly budget needs to be kept as strict as possible. This means that you have to precisely know what you are spending every month. If you have a family of four, you need to understand that each family member is on track to making monthly payments. Knowing exactly where the money is going is the only way to ensure that the spending is reasonable and within your budget. Second, you need to have a clear understanding of your monthly expenses. How much do you need to purchase every month? What can you get along without? Once you have this information, you can hone in on what you need. Third, you need to make regular monitoring of your spending a priority. If you’re not actively keeping track of your spending, you are more likely to go overboard and indulge in habits that will negatively impact your finances.

Create a Budget

When it comes to tracking your spending, a few apps and tools are hands down the best. Budgeting for the Future, by Mint.com, is one of the most popular budgeting apps, and users can stay on top of their spending with their mobile devices. Another helpful app is Paycheck, which allows users to track their income and expenditure across various bills and gifts and create a budget.

Eliminate Unnecessary Expenses

You don’t need to dig too deeply into your monthly budget to realize that certain expenses can’t be eliminated when it comes to saving money. Things like utilities, internet, and phone service are vital to surviving as an adult – and they are all provided to you for free or at a reduced rate. These services can be challenging to remove from your monthly budget, but you can make adjustments that will result in savings.

Identify Good Financial Habits

There are some situations where using a prepaid phone over a regular telephone makes sense. Whether you work from home or spend most of your time away from home, it can be great to have a phone that you can pay for upfront, rather than figuring out how to cut corners and using a government program that provides less reliable service. You also control your data plan to decide how much you want to spend each month on calls and data.

By following these four simple ways, you can make significant strides towards building a better financial future.